Did you know Toronto condo prices are going up more than 10% each year?

Statistics gathered over the last few years show how much the average price of a Toronto condo or condo townhouse has appreciated from the previous year:

2019 – 11.9%

2018 – 11.4%

2017 – 10.3%

With this consistent upward trend, it becomes costly to wait to get into the real estate market.

Just think of the equity appreciation that you are missing out on right now!

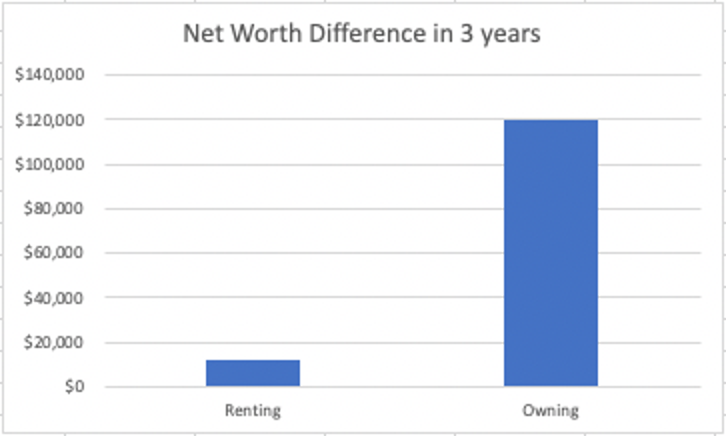

If you buy a $500,000 condo today and even if that condo goes up by (a conservative) 6.5% each year – after 3 years your net worth would have increased by $120,000!

Are you better off financially by saving for a higher down payment or getting into the market now with the minimum 5% down-payment?

For example, let’s say you are renting an apartment now and are saving $500 each month towards your down payment – that works out to $12,000 per year.

Now, for the sake of this exercise, let’s say these savings have an investment return of 6.5% per year. How much are your savings appreciating each year? That works out to $780 increase in your net-worth after 3 years.

Here is an illustration showing you how great real estate can be as a wealth building tool.

Getting in the market now, gives you options in the future. With the way the market has appreciated over the last 3 years, you just can’t out-save the market right now. Purchasing a starter condo now allows you to start growing your net worth at a rate that will give you the best chance of purchasing your dream home in the future.

Even though your first home may not be your “dream home”, it’s a step towards your financial future. You are better off being invested in the real estate market long term and watching your net-worth grow.

To helping you create remarkable realestate results,

Alex and Elaine

Connect with Alex Kluge

- Phone: 416-562-7400

- Email: alexkluge@royallepage.ca

- Book: Virtual or in-person meeting

Connect with Elaine Mok

- Phone: 416-420-6312

- Email: elainemok@royallepage.ca

- Book: Virtual or in-person meeting

.png)

Post a comment